Bonus depreciation calculation example

The you dont receive any further depreciation deduction the following year or even subsequent years even if you otherwise have remaining depreciable basis in the asset. The exact percentage of an assets cost that may be written off in the first year has ranged from 30 to 100 since bonus depreciation was first created by the Job Creation and Worker Assistance Act of 2002 during the George W.

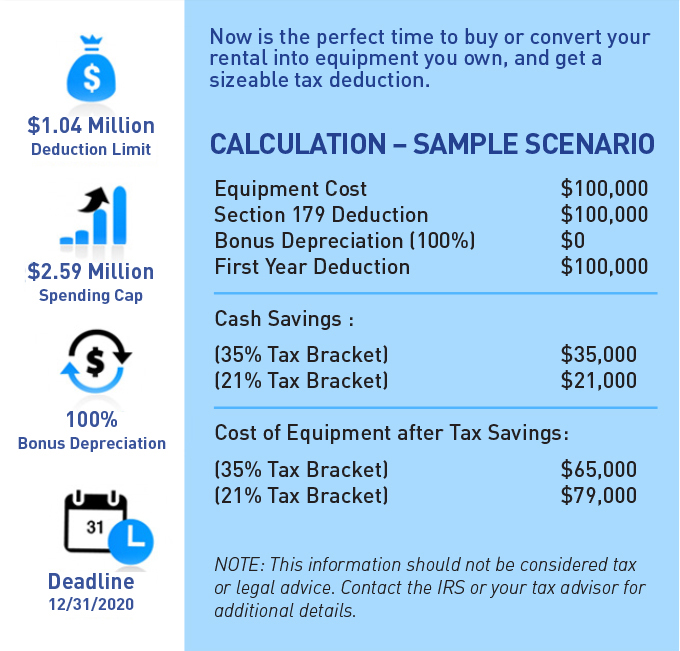

Take Advantage Of The Section 179 Tax Deductions Highway Equipment Company

For tax year 2018 a taxpayer has a trade or business that generated 2000000 of gross income 800000 of operating expense 400000 of business interest expense and 300000 of depreciation expense.

. Depreciation limits on business vehicles. In comparison equipment which generally qualifies for full expensing treatment under the 100 percent bonus depreciation provision of the TCJA makes up just 15 percent of the private capital stock. For example if you purchase a computer for 1500 you generally cant deduct the entire 1500 in the same year that you purchase the computer unless it qualifies for bonus depreciation or Section 179.

Whirlpool Refrigerator Led Lights Flashing. Minnesota for example allows a business to deduct 20 of the federal Bonus Depreciation. Your bonus amount simply becomes part of your total taxable income for the year which may impact your tax bracket ie.

If it is mailed you should allow adequate time to receive it before contacting the payer. The percentage of tax you pay on your income. Read more of 8000.

Must contain at least 4 different symbols. If we refer to other tables then we use the resulting sums. The percentage of bonus depreciation phases down in 2023 to 80 2024 to 60 2025 to 40 and 2026 to 20.

It would only be 5000 using Bonus Depreciation. We welcome your comments about this publication and your suggestions for future editions. The column Calculation of the indicator indicates the place we are taking the data from.

To estimate the calculation of the production cost of packages conditional indicators of OS depreciation percentages of additional wages and taxes mandatory insurance premiums are taken. However you can deduct a portion of the cost each year using the MACRS depreciation method. Using the above example your basis in the housethe amount that can be depreciatedwould be 99000 90 of 110000.

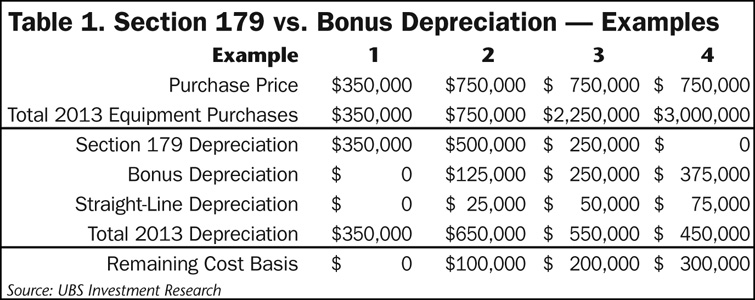

We can demonstrate the difference by using an example. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. An individual states tax laws will have an impact on which deduction you choose.

As of 2020 the bonus depreciation rates are as follows. The facts are the same as in Example 2 except you elect to use the flat rate method of withholding on the bonus. These assets had to be purchased new not used.

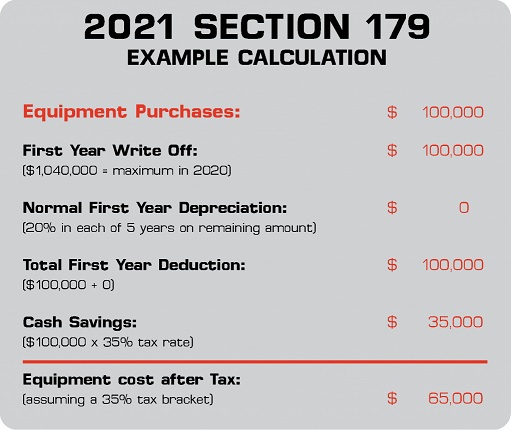

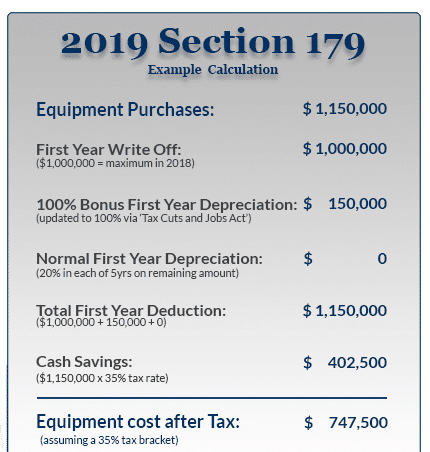

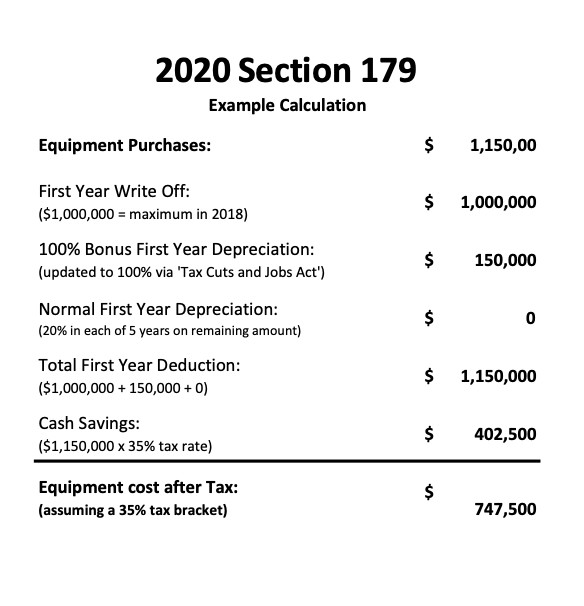

NW IR-6526 Washington DC 20224. Maximum allowed Section 179 write-off 1040000 Bonus depreciation for remaining cost 1060000 Total write-off in year one 2100000 Net income has now been reduced by the full purchase price of 2100000. Section 179 deduction dollar limits.

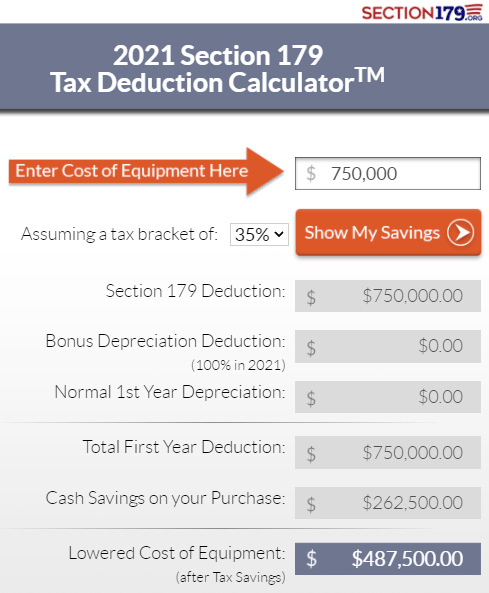

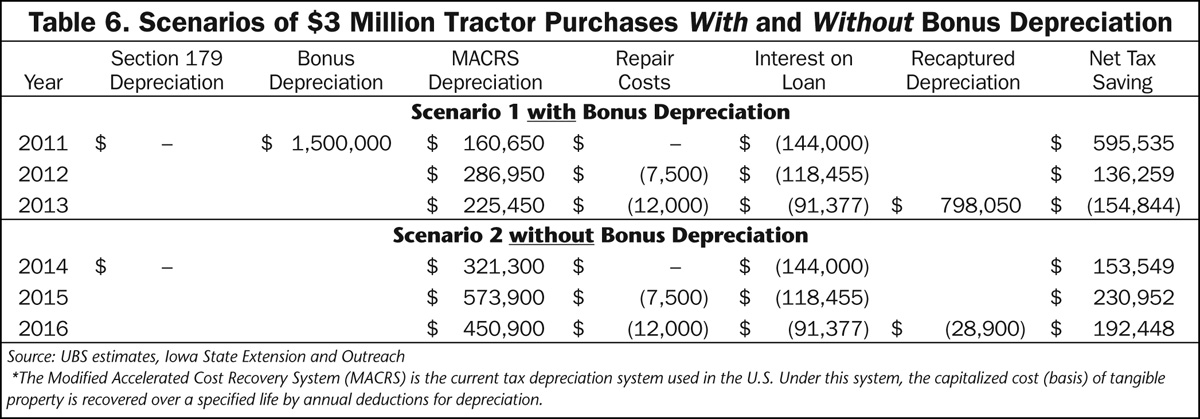

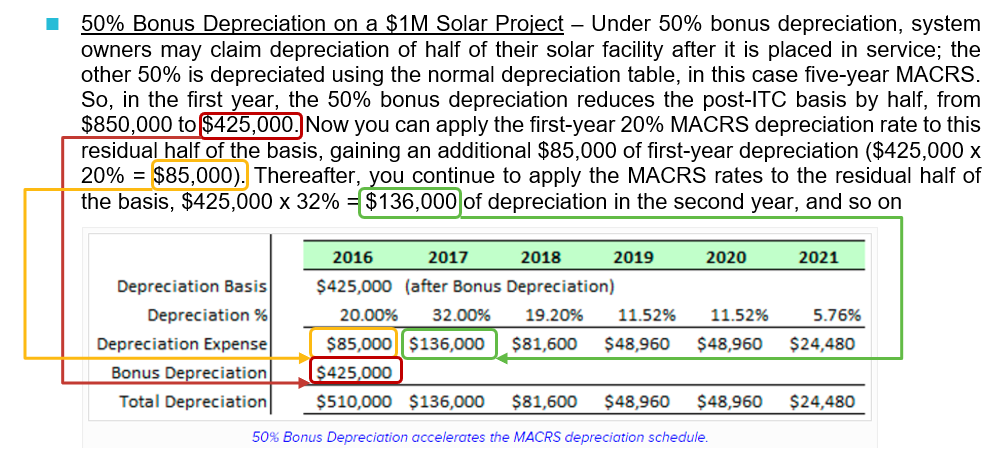

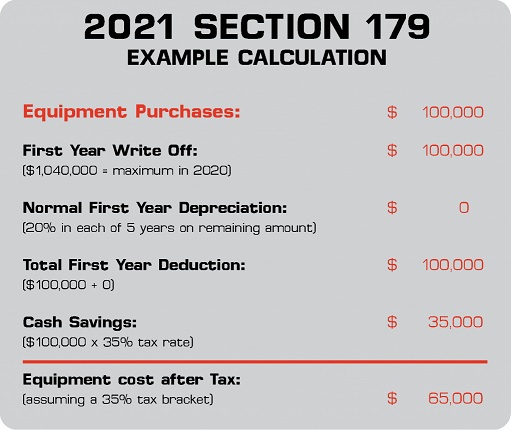

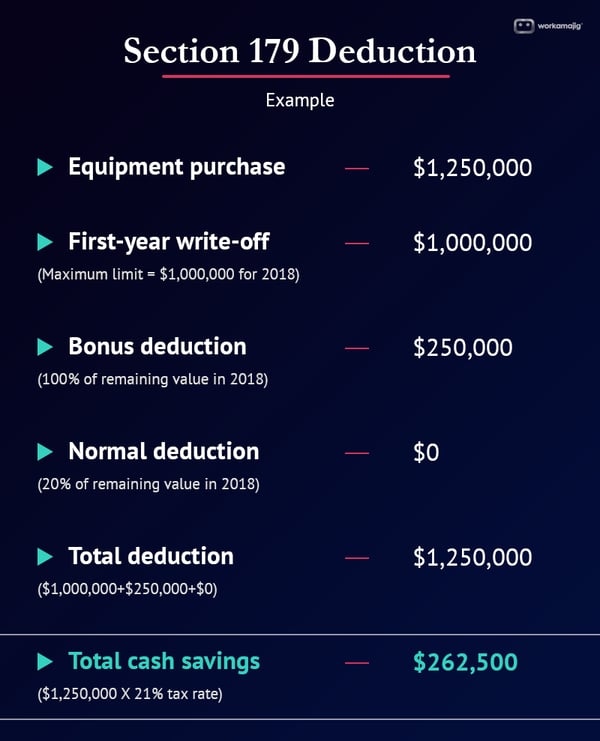

Given that structures comprise the largest share of the capital stock improving the tax treatment of this asset class would likely have a large. Starting in 2023 the percentage of capital equipment that can be expensed immediately drops 20 per year eg 80 in 2023 and 60 in 2024 until the provision drops to 0 in 202714 Example of a Calculation A generic example can help illustrate how each incentive could be calculated and applied at a business. Let us take the simple example of a building bought for 100000 and is estimated to have a salvage value Salvage Value Salvage value or scrap value is the estimated value of an asset after its useful life is over.

You withhold 22 of 1000 or 220 from Sharons bonus payment. So for a vehicle if you claim section 179 and Bonus depreciation on a vehicle the 1st year. The calculation is illustrated as.

After switching to LEDs or when replacing a faulty LED lamp in some cases the LED light will start flickering We will explain temperature settings alarm sounds door not closing water filter changes not cooling issues not making ice no power strange sounds leveling ice makers water dispensers This refrigerator has the. Depreciation is an important part of your businesss tax returns. The amount of tax withheld in your bonus month depends on which method your company uses to calculates tax.

Get 247 customer support help when you place a homework help service order with us. Equipment Purchase Price 2100000. Depreciation is often misunderstood as a term for something simply losing value or as a calculation performed for tax purposes.

The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply. 2023 to 80 2024 to 60 2025 to 40 and. Your basis in the land would be 11000 10 of 110000.

On a purchased piece of equipment that costs 25000 the Minnesota deduction would be 25000 using Section 179. The percentage of bonus depreciation phases down in. For example if you have 5000 in business.

The bonus depreciation calculation will depend on the year you placed the asset in service. For example a 25000 vehicle and you claim 10100 Sect 179 and 8000 bonus. For example if you received taxable interest of 10 or more the payer is required to provide or send Form 1099 to you no later than January 31 2022 or by February 15 2022 if furnished by a broker.

Congress intent with bonus depreciation of course is to stimulate the economy. The new rules allow for 100 bonus expensing of assets that are new or used. ASCII characters only characters found on a standard US keyboard.

6 to 30 characters long. The old rules of 50 bonus depreciation still apply for qualified assets acquired before September 28 2017. For example if a companys machinery has a 5-year life and is only valued 5000 at the end of that time the salvage value is 5000.

The new rules allow for 100 bonus expensing of assets that are new or used. You withhold 22 of 1000 or 220 from Sharons bonus payment. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

If you still dont get the form by February 15 or. Which Applies GDS or ADS. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Starting in 2023 the percentage of capital equipment that can be expensed immediately drops 20 per year eg 80 in 2023 and 60 in 2024 until the provision drops to 0 in 202715 Example of a Calculation A generic example can help illustrate how each incentive could be calculated and applied at a business. These assets had to be purchased new not used. Note that the IRS requires Section 179 depreciation to be calculated before bonus depreciation.

The old rules of 50 bonus depreciation still apply for qualified assets acquired before September 28 2017. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022.

Bonus Depreciation Definition Example How Does It Work

The Current State Of The Section 179 Tax Deduction

Bonus Depreciation And The Macrs Youtube

Depreciation Macrs Youtube

Section 179 And Bonus Depreciation In 2013 Blackburn Childers Steagall Cpas

How Special Depreciation Rules Impact Farm Equipment Purchases

How Special Depreciation Rules Impact Farm Equipment Purchases

Primer On Bonus Depreciation Scottmadden

Standard Mileage Deduction Vs Section 179 For Rideshare Drivers

2020 Section 179 Commercial Vehicle Tax Deduction

Calculate Add Back Of Federal Bonus Depreciation For State Reporting Depreciation Guru

Depreciating Farm Property With A 20 Year Recovery Period Center For Agricultural Law And Taxation

Section 179 Tax Deduction Gt Mid Atlantic

Experience Maximum Tax Savings In 2018 With 100 Bonus Depreciation Shawmut Equipment Crane Sales Rentals Parts Service

Section 179 Deduction A Guide For Creative Agencies

Depreciation Starting With The Basics Ilsoyadvisor

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group